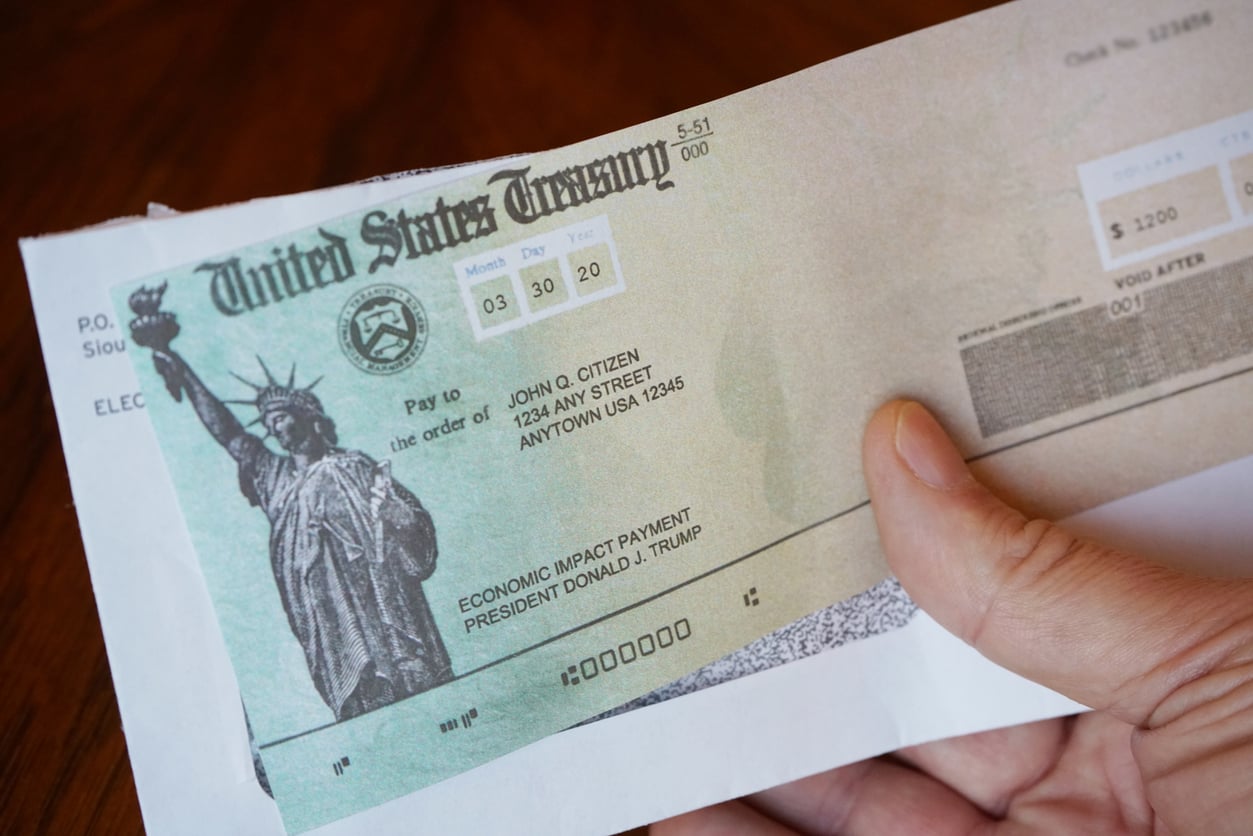

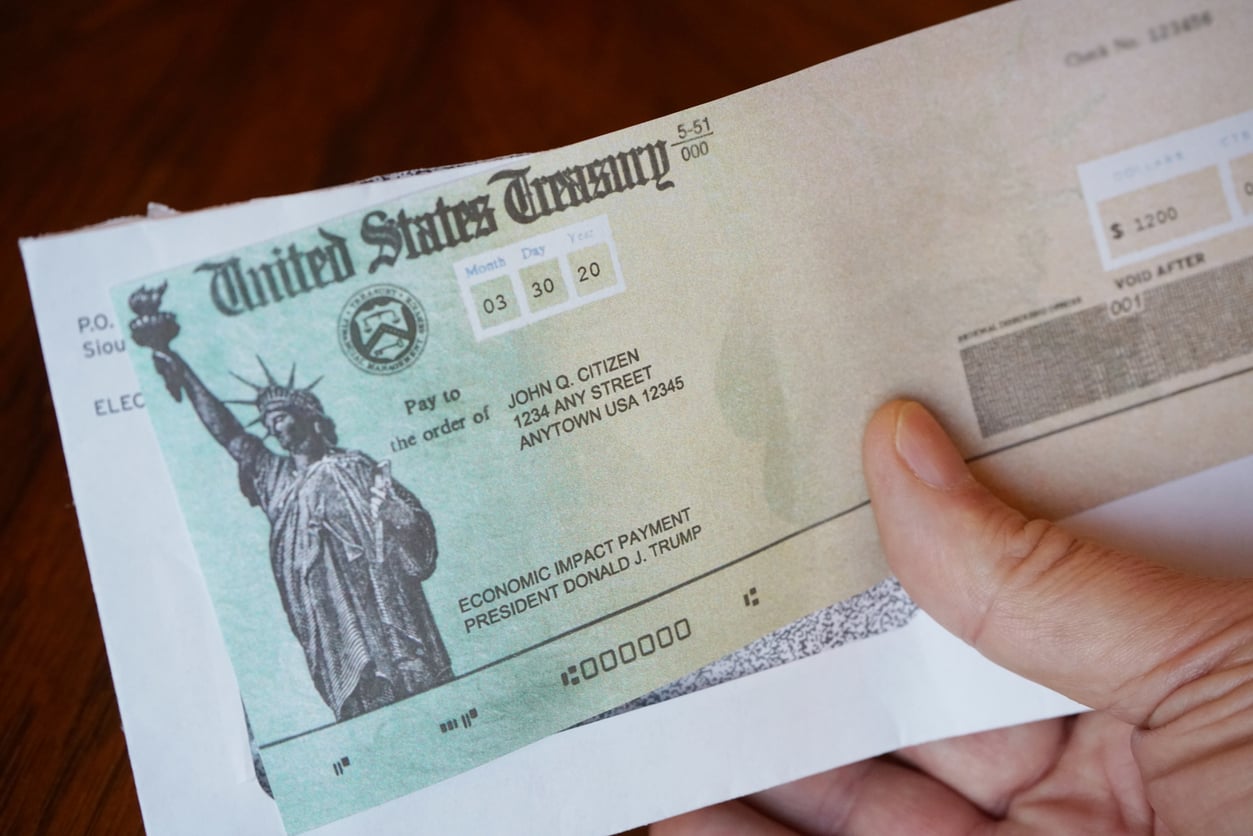

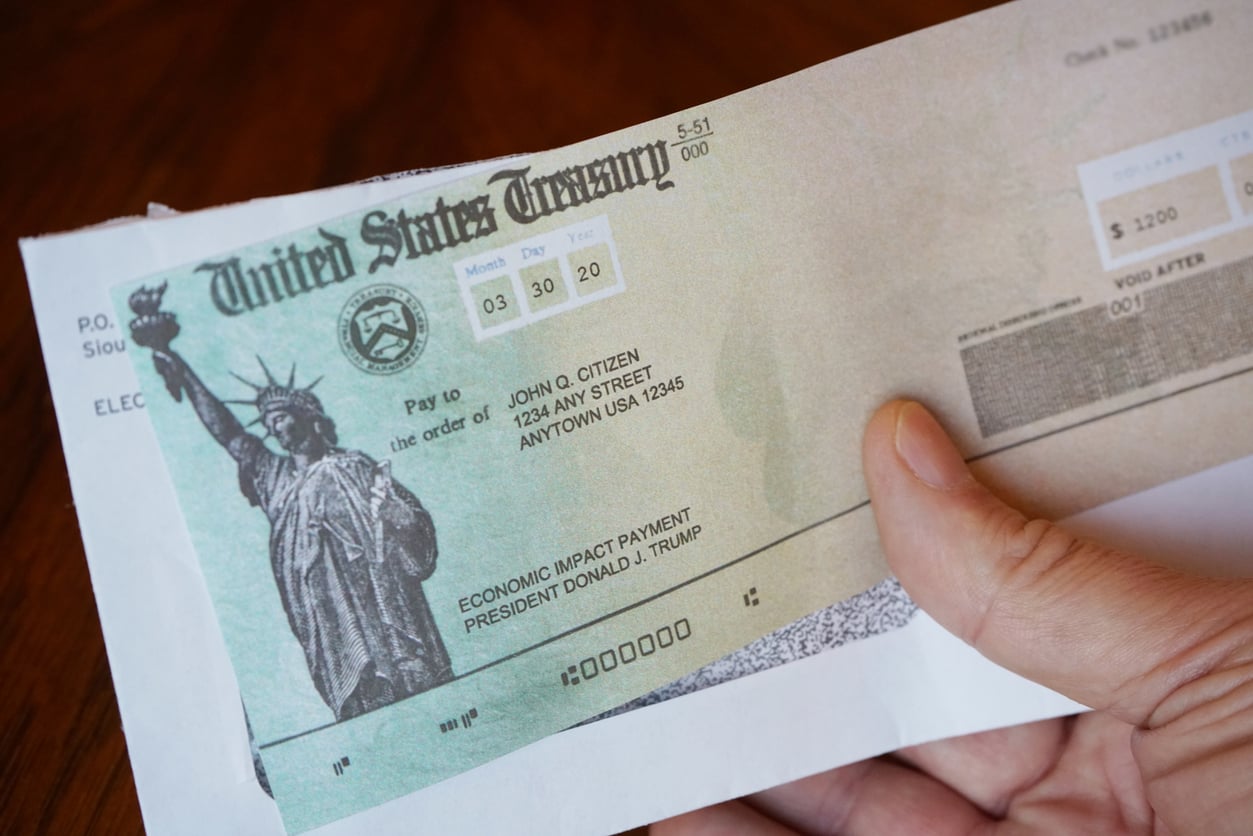

Americans Can Still Qualify for Stimulus Checks and Tax Rebates. Find Out Which States Are Sending Out Checks

Even though the federal government is no longer giving any stimulus checks out, there are several states which are taking matters into their own hands. Here’s a list of states that will be working on to get their residents more aid.

California

Residents of California can expect payments to go out in October by direct deposit or with pre-paid debit cards.

The payments will be worth up to $350 for a single taxpayer or up to $700 for couples who fill jointly if they make less than $150,000 per year.

An extra $350 stimulus payment will go out to households with any dependents.

Florida

Florida recently approved a budget that will pay its residents up to $450 to help offset the rising costs of inflation before the start of the new school year for the child in the recipient’s care.

Checks are expected to be sent out on or before July 25, so eligible residents should be getting them right now.

People enrolled in the state's Guardian Assistance Program or Temporary Assistance for Needy Families, relative or non-relative caregivers of children, and foster parents may all be eligible for the payout.

Those who qualify, will automatically receive the checks.

Colorado

The state of Colorado will be sending out cash stimulus payments worth at least $500.

The payments are to go out in October.

Every resident living in the state of Colorado full time that filed a tax return by July 30 can expect to see a payment.

The amount of the payment will depend on the total state revenue.

Georgia

Thanks to a state surplus, residents of Georgia will see stimulus payments worth up to $250 per single filler or $500 for joint fillers. Head of household filers will see payments of up to $375.

Georgians who filed their 2020 and 2021 state tax returns can expect to see the payment.

The amount of payment will be determined by the tax filing statuses.

Illinois

Residents of Illinois who make less than $200,000 per year as single filers will receive rebate checks worth $50.

Married couples filing jointly who make less than $400,000 can expect payments of $100 and $100 more for each added dependent (up to three).

Idaho

Residents of Idaho will receive rebate checks or direct deposits based on their 2020 taxes. This rebate will amount to the greater of 12% of their taxes or $75.

The payments are expected have started to go out in May this year.

If you meet at least one of the two criteria, you will qualify to receive the payment:

1. You have to be a full time Idaho resident that filed a 2020 and 2021 state tax return.

2. You have to be a full time Idaho resident that filed grocery credit refund returns.

Maine

The governor Janet Mills has proposed sending Maine residents stimulus checks that will come from the state’s $682 million surplus.

Maine residents making less than $100,000 as a single filer will receive stimulus checks worth maximum of $850. Heads of household making less than $150,000 will also see $850 payments.

Married couples filing jointly with an income below $200,000 will receive a payment worth $1,700.

Residents who want to qualify for the payment must file their 2021 tax return until Oct.31, 2022.

Indiana

Indiana residents are receiving a stimulus payment worth of $125 per resident no matter their income.

The payments are made either via direct deposit or mailed as a check.

Most Indiana residents, who filed their 2020 states taxes before Jan. 3, 2021, are eligible to receive these payments.

Minnesota

Residents of Minnesota can expect stimulus checks worth up to $750. Workers on the frontlines during the pandemic could qualify for the bonuses if their jobs put them at risk of getting the virus.

Workers must have worked for a minimum of 120 hours between May 15, 2020, and July 30, 2021, in a front-line position in the state in order to be eligible.

If you have a partner who is also a frontline worker, and your joint income doesn’t exceed $349,999, you can both qualify for the bonus check.

Individuals' incomes who worked directly with patients are limited to $175,000 per year between Dec. 2019 and Jan. 2022.

The applications have come to an end on July 22.

Virginia

The state of Virginia is offering a one-time tax rebate worth $250 for residents who filed their tax returns before the 1st of July this year.

Married couples filing jointly will see a payment of $500.

Payments will be distributed via direct deposits and paper checks and are expected to go out in October.

New Jersey

New Jersey state residents are expected to see stimulus checks of $500.

Low-earning taxpayers who filed using a tax identification number rather than a Social Security number in order to provide a financial boost.

Delaware

Residents of Delaware who filed their 2020 state tax return are receiving a tax rebate worth $300.

If you are eligible but have not yet claimed your rebate, instructions will be provided by October 17.

The payment could only have been claimed by submitting a tax return for 2020.

Oregon

Qualifying Oregon state residents will receive payments of $600.

Residents who received earned income tax credit on their 2020 tax return can expect the payments.

To qualify for the payment, you have to be resident of Oregon for the last 6 months of 2020.

The payments have gone out between July 23rd and August 1st this year.

Hawaii

State of Hawaii is giving out payments worth $300 to residents who earn less than $100,000 per year.

Anyone earning over $100,000 will receive payments worth $100.

An extra payment will go out for every dependent.

Payments are expected to go out as soon as late August.

South Carolina

Qualifying taxpayers from South Carolina will receive payments worth up to $800.

More information will be announced later this year.

New Mexico

Residents of New Mexico state should expect multiple payments.

Those who filed their 2021 state tax return and make less than $75,000 as single filers or less than $150,000 as joint filers, are getting rebates worth $250 and $500.

Payments have already gone out this July.

If you have not yet received your payment, you have to file your 2021 tax return until May 31, 2023.